Getting Started

Assets & Market Data (included with Enterprise)

Exchanges (included with Enterprise)

Markets (included with Enterprise)

Research

Stablecoins

Protocols

Token Unlocks

Fundraising

MessariAI API

Signals

Developer Resources

Get research reports

Copy

Ask AI

curl --request GET \

--url https://api.messari.io/research/v1/reports \

--header 'X-Messari-API-Key: <api-key>'Copy

Ask AI

{

"error": null,

"data": [

{

"id": "3f9ff008-a798-4f6e-85c7-a6a109e8832c",

"createdAt": "2025-08-22T16:52:34Z",

"updatedAt": "2025-10-17T17:23:12Z",

"assetIds": [

"4515ba15-2719-4183-b0ca-b9255d55b67e",

"51f8ea5e-f426-4f40-939a-db7e05495374",

"ad1342eb-a5fe-4c60-b37e-71a8859f0fea",

"784b12bc-b284-4689-9b97-8ea7fec440ba",

"bcbe9ab0-8a03-4295-bd4c-5e4d7caf1026"

],

"assets": [

{

"id": "4515ba15-2719-4183-b0ca-b9255d55b67e",

"name": "USDC",

"symbol": "USDC",

"slug": "circle-usdc-stablecoin"

},

{

"id": "51f8ea5e-f426-4f40-939a-db7e05495374",

"name": "Tether",

"symbol": "USDT",

"slug": "tether"

},

{

"id": "ad1342eb-a5fe-4c60-b37e-71a8859f0fea",

"name": "Pax Dollar",

"symbol": "USDP",

"slug": "pax-dollar"

},

{

"id": "784b12bc-b284-4689-9b97-8ea7fec440ba",

"name": "Agora Dollar",

"symbol": "AUSD",

"slug": "agora-dollar"

},

{

"id": "bcbe9ab0-8a03-4295-bd4c-5e4d7caf1026",

"name": "Official Trump",

"symbol": "TRUMP",

"slug": "official-trump"

}

],

"authors": [

{

"id": "6a7f467f-5dbf-4ba5-a8b4-499af94fd2c4",

"name": "Dylan Bane",

"image": "https://cdn.sanity.io/images/2bt0j8lu/production/db9a9c7bcea81c62c3ebabff017525acf5bf7bd3-772x780.png?w=100",

"linkedinUrl": ""

}

],

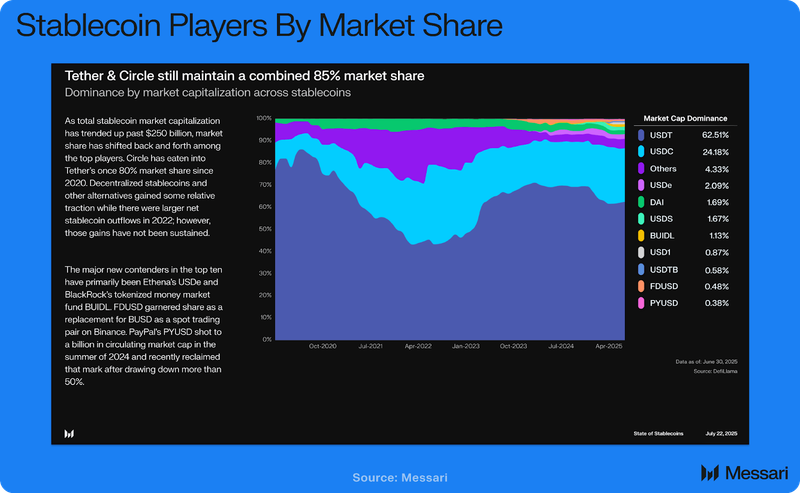

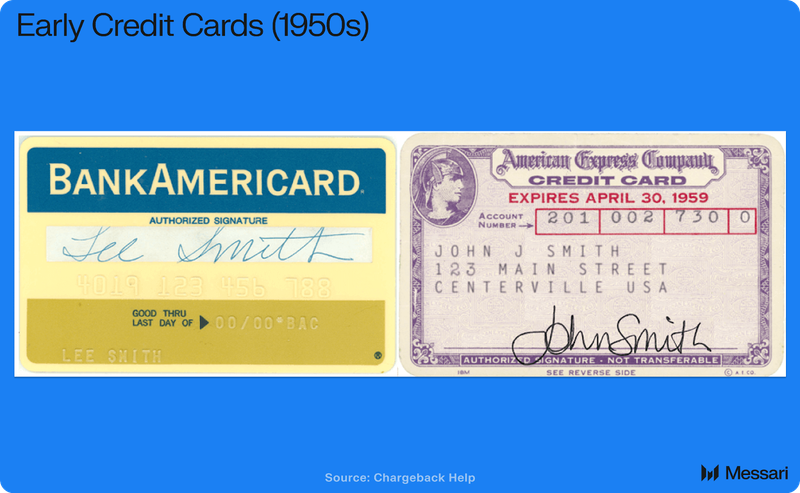

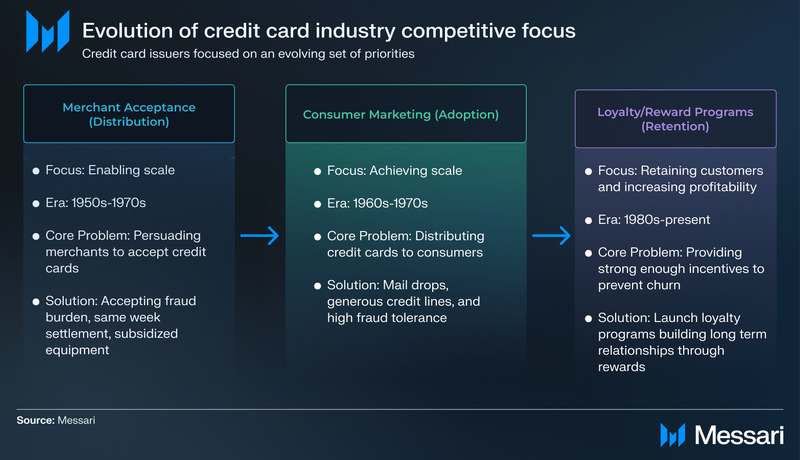

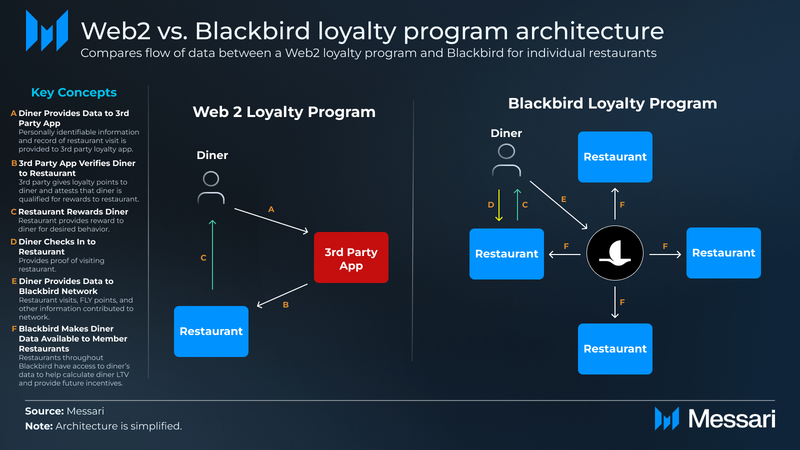

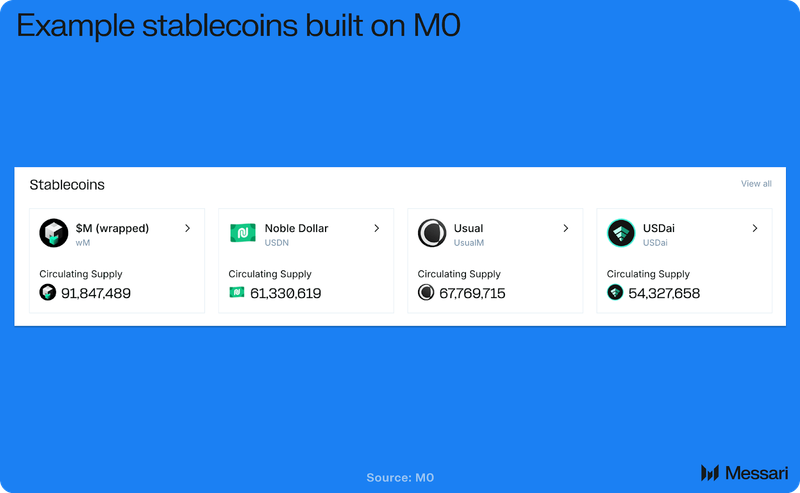

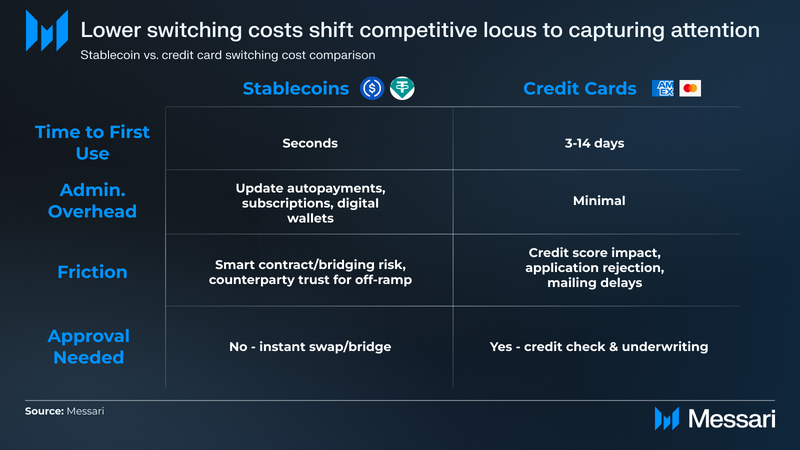

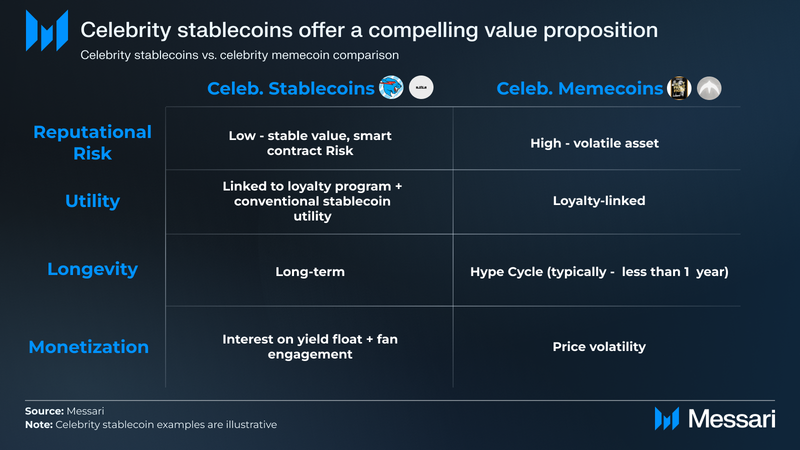

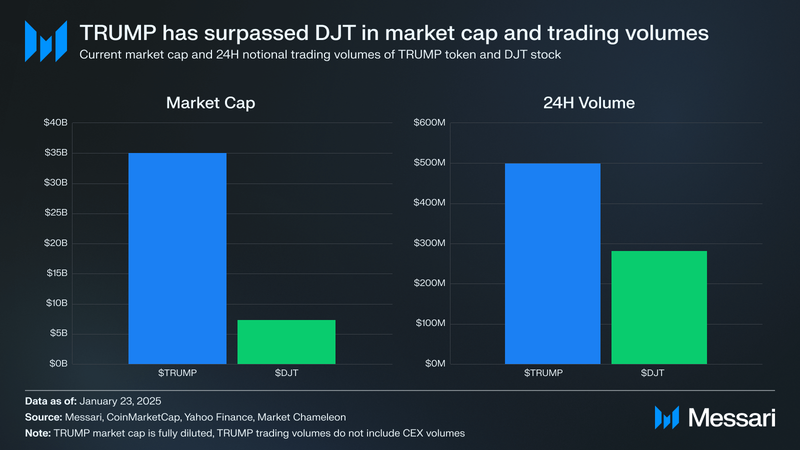

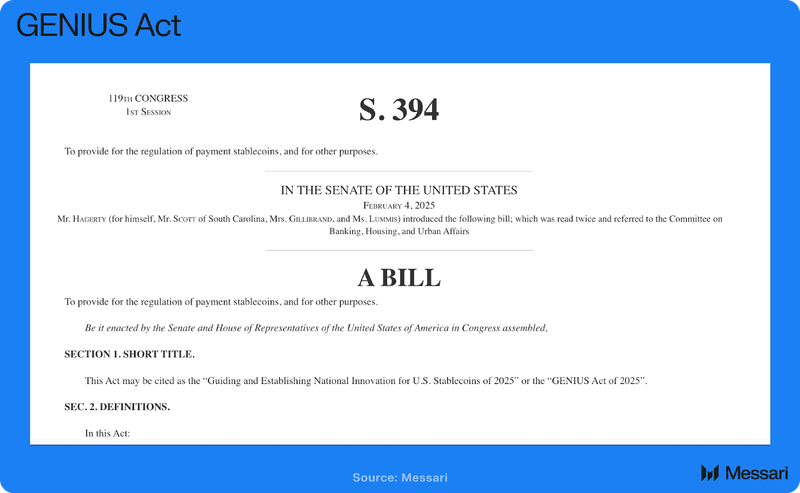

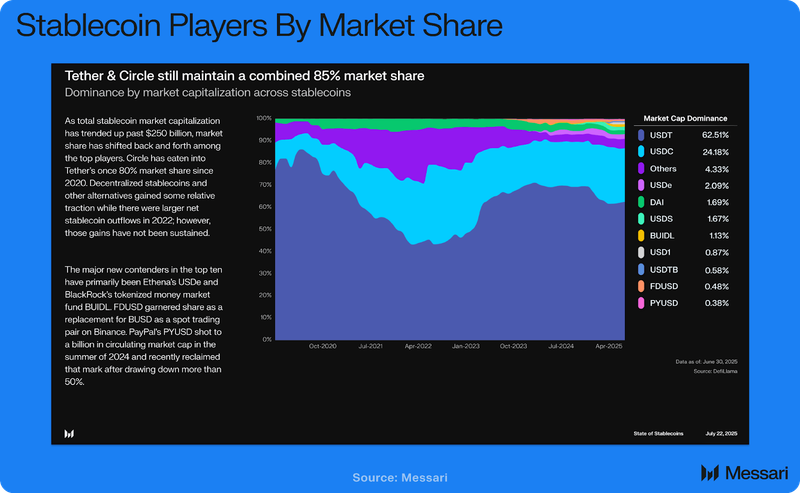

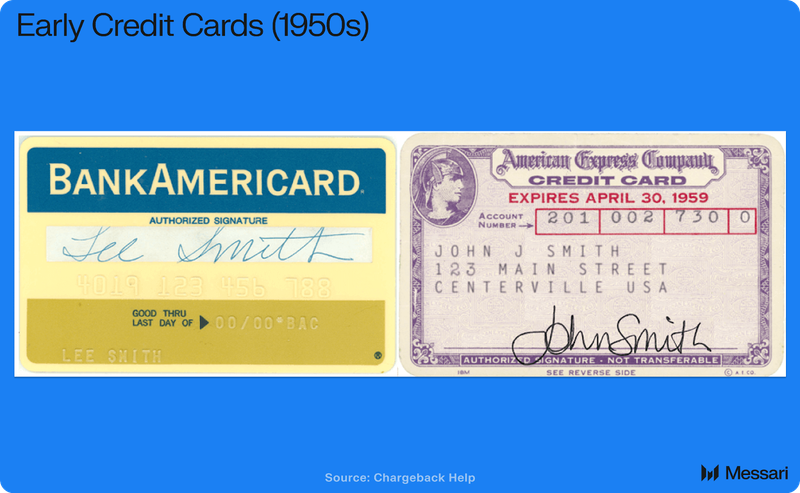

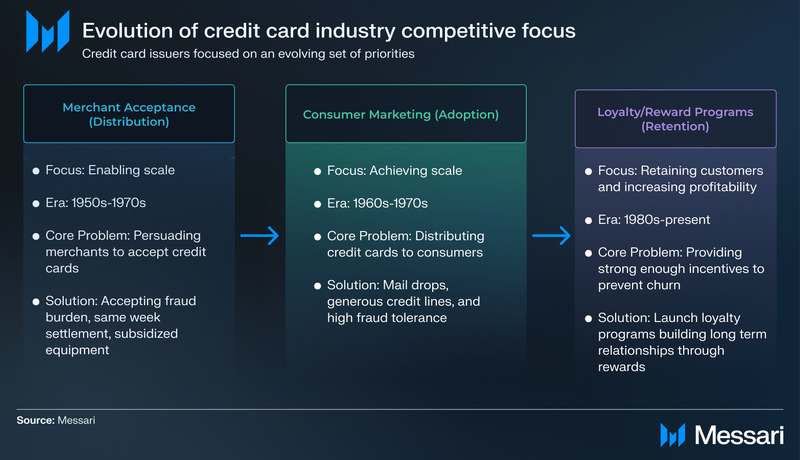

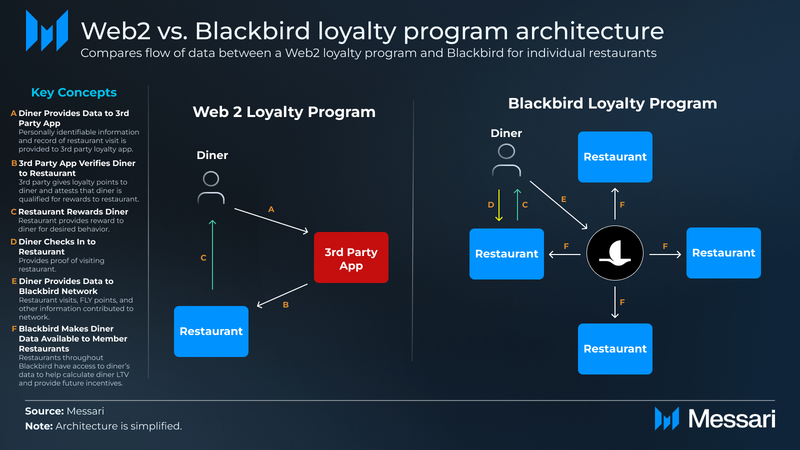

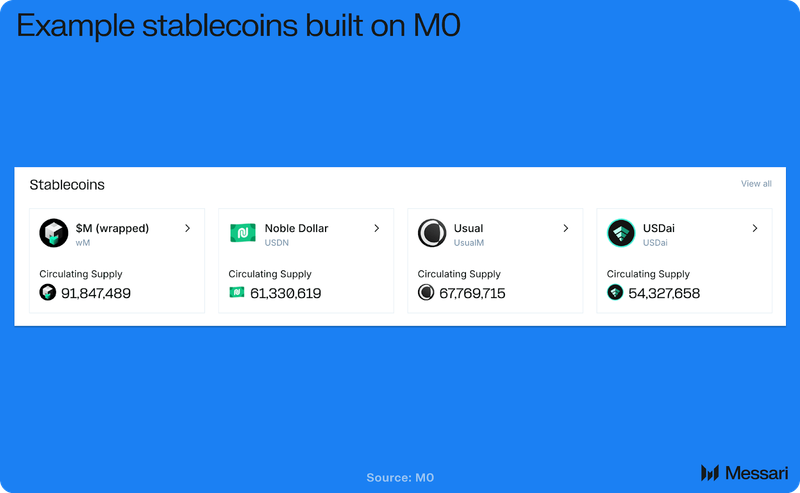

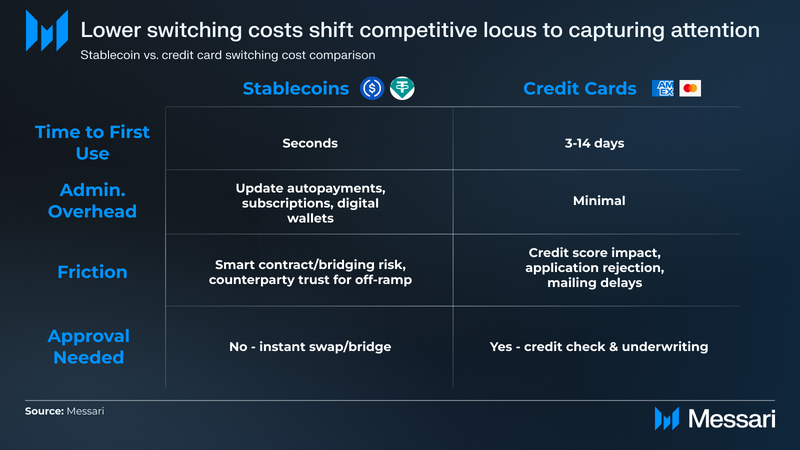

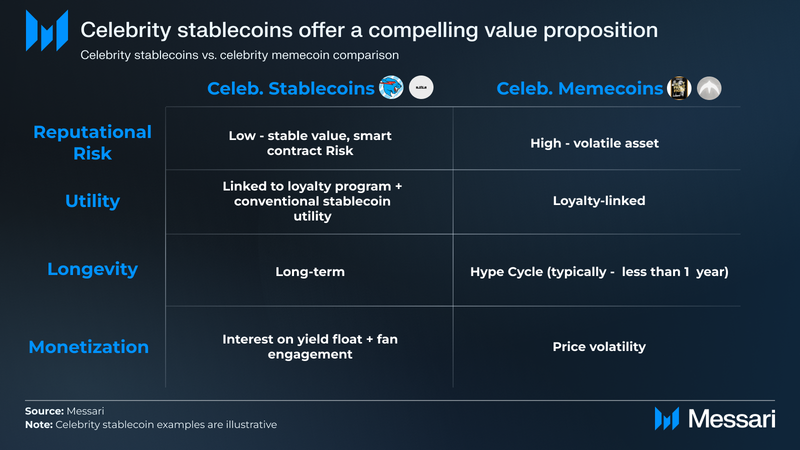

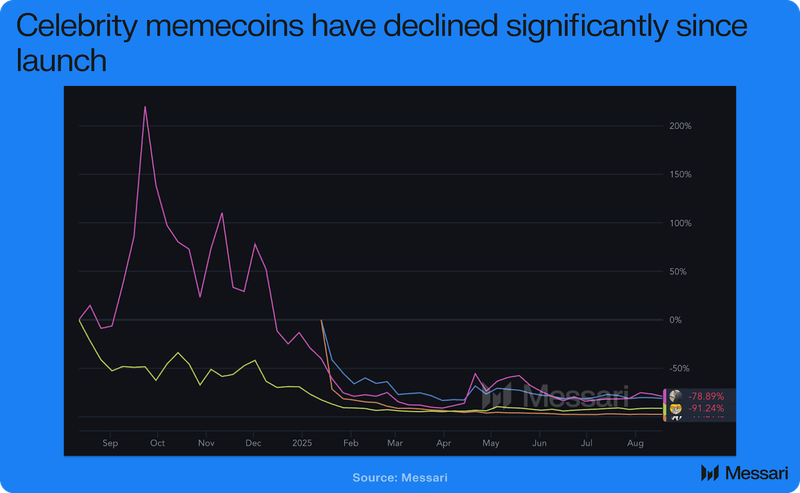

"content": "## Introduction\n\nStablecoin adoption has advanced from serving as crypto-native financial primitives to powering mainstream payments.\n\nWith the passage of stablecoin regulation in the U.S. (e.g., [GENIUS Act](https://www.congress.gov/bill/119th-congress/senate-bill/394/text)), the entrance of new issuers from [Big Fintech](https://www.reuters.com/technology/crypto-firms-including-robinhood-kraken-launch-global-stablecoin-network-2024-11-04/) and [TradFi](https://www.cnbc.com/2025/06/17/jpmorgan-stablecoin-jpmd.html), and public equities increasingly [assigning a premium](https://fortune.com/2025/06/10/circle-ipo-stock-price-valuation-outlook/) to stablecoin-linked businesses, developing a long-term thesis on the trajectory of stablecoins and tokenization is essential for both crypto-native stakeholders and financial professionals.\n\n\n\nToday, market participants remain focused on the current competitive battleground: **distribution.** Control of on- and off-ramps, exchange listings, wallet integrations, liquidity depth, and merchant acceptance determines who wins share in the short term. Yet this view is incomplete. Once distribution consolidates around a handful of long-term incumbents, the locus of competition will shift.\n\nThis report argues that the **next differentiators** will be:\n\n* **Loyalty** – programmable, onchain rewards that resemble but surpass traditional credit card points. \n\n* **Attention** – the cultural and celebrity reach that determines which brands capture consumer mindshare.\n\nTogether, these forces will shape the next phase of the “stablecoin wars.”\n\nIn addition, we advance the thesis that **Branded Stablecoins** and, over time, **Branded RWAs** in the form of co-branded or white-labeled tokens representing offchain assets, will be the natural evolution of this market. These instruments will not only secure user loyalty but also channel cultural capital into financial adoption. Investors, issuers, and partners who fail to account for this shift in their tokenization outlook risk underestimating the future bottlenecks of competition.\n\n## Stablecoin Economics and the Limits of Distribution\n\nStablecoins offer one of the most attractive business models in the world. Issuers earn risk-free yield on the float of cash and Treasury bills backing their tokens. At current supply levels (just over [$250 billion](https://messari.io/report-pdf/b712a2f7e09bdd7925df633589d48f2b0ce769ac.pdf) as of mid-2025) and prevailing yields (around 5%), annualized revenue exceeds $12 billion across issuers. \n\nDue to the size of the opportunity, large established companies in TradFi, fintech, and crypto are actively entering the market, which is currently dominated by two large incumbents, [Tether](https://messari.io/project/tether) and [Circle](https://messari.io/project/circle-usdc), which account for a [combined 85% of stablecoin market share](https://messari.io/report-pdf/b712a2f7e09bdd7925df633589d48f2b0ce769ac.pdf).\n\n\n\nBut money is a commodity. A dollar issued by Circle, PayPal, or JPMorgan remains just a dollar. As regulatory standards crystallize, the main competitive fight is over distribution, on-ramps, exchange listings, wallet integrations, merchant acceptance, and the like. Indeed, distribution is so critical that Circle gives up [~61% of its yield](https://www.businesswire.com/news/home/20250812836620/en/Circle-Reports-Second-Quarter-2025-Results) on float to platforms like Coinbase.\n\nDistribution will be critical, and may, indeed, be the primary driver of market share early on. But issuers that fail to win on distribution will quickly look for alternative levers. \n\nTwo areas stand out: **loyalty** (programmable onchain rewards) and **attention** (brand + celebrity reach).\n\n## Lessons from Credit Cards: Distribution, Adoption, and Loyalty\n\nTo understand why, the evolution of credit cards can point us in the right direction.\n\nIn the early decades of credit cards, merchant acceptance defined the competitive battleground**.** A card’s utility depended entirely on where it could be swiped, so issuers raced to build the [broadest possible network](https://finanso.com/us/blog/when-were-credit-cards-invented-the-history-of-credit-cards/?utm_source=chatgpt.com) of participating merchants. Without that foundation, consumer demand could not be unlocked. The first problem to solve was the scale of usage.\n\n\n\nOnce merchant acceptance reached critical mass, competition shifted to **mass consumer adoption.** Banks and card networks marketed credit cards as safer and more convenient than cash, emphasizing fraud protection and ease of use. Direct mail campaigns, aggressive sign-up bonuses, and generous credit lines pulled [millions of new users](https://worldhistoryjournal.com/2025/06/22/credit-card-history/?utm_source=chatgpt.com) into the system. By the 1970s and 1980s, carrying a credit card was no longer novel; it was the norm for the American middle class.\n\nWith both sides of the network in place, issuers needed a new lever to differentiate themselves. This is where **points and loyalty programs** emerged as the defining edge. The 1981 Citibank-American Airlines partnership pioneered the model, showing that a card could offer more than credit; it could offer [rewards](https://www.ft.com/content/85ddff1e-9552-4ff9-ae59-b688e2984d20?utm_source=chatgpt.com)**.** Airline miles, and later cashback programs, created a new layer of competition: not just who had the broadest merchant network or best introductory offer, but who could connect spending to a broader lifestyle.\n\n\n\nRewards reshaped consumer behavior because they shifted the frame of reference. Spending on a particular card wasn’t just a transaction; it was progress toward a free flight, a hotel stay, or cash back. This made [usage habitual](https://www.businessinsider.com/airlines-credit-cards-loyalty-miles-rewards-profits-delta-united-american-2025-5?), not occasional, and cemented credit cards as the dominant consumer payment rail.\n\nEven today, rewards remain one of the most powerful differentiators. Roughly [60% of U.S. consumers](https://www.ipsos.com/en-us/majority-say-credit-card-rewards-are-very-important-and-drive-their-card-usage) say rewards are very important in their choice of credit card, and [49% report they would switch cards](https://www.ipsos.com/en-us/majority-say-credit-card-rewards-are-very-important-and-drive-their-card-usage) if a better rewards program were available. For partnered companies, loyalty economics can be even more lucrative. Delta’s co-branded credit card program with American Express generated **$6.8 billion in revenue in 2023**, accounting for [70% of the airline’s total profit](https://www.ft.com/content/d9121c2e-0444-4f33-86fb-36d34c68c228?utm_source=chatgpt.com).\n\nAltogether, the credit card industry demonstrates that loyalty programs are a **three-way win**: compelling for issuers, sticky for consumers, and immensely valuable for partners.\n\nThe historical progression, distribution, adoption, and then loyalty, offers a playbook for how today’s stablecoin issuers may compete once distribution consolidates.\n\n## Onchain loyalty programs \n\n### A Broader Design Space\n\nOnchain loyalty unlocks a much broader design space than traditional card programs. Consumers can **selectively share verified payment histories** with third parties, enabling new forms of personalized rewards. A traveler who spends heavily on international flights, for example, could prove that pattern onchain and receive tailored offers from luxury retailers or hospitality partners. Because payment activity is transparent and verifiable, issuers and brands can build **composable loyalty programs** that maximize consumer value in ways legacy systems cannot match.\n\nWe’re already seeing this model in action. [Blackbird](https://messari.io/report/blackbird-fly-blackbird-fly-a-model-for-web3-loyalty-programs), an onchain restaurant discovery and loyalty platform, gives restaurants access to customer dining data and visit histories. In exchange for data sharing, restaurants provide personalized incentives that deepen relationships, increase repeat visits, and maximize diner LTV. For an industry with razor-thin margins, such programs can be the most effective lever for revenue and profitability.\n\n\n\nStablecoins extend the same principle at a global scale. As issuers and partners look beyond distribution, they will compete by embedding **programmable loyalty features directly into the currency itself.** In this model, the “best” stablecoin is not only the one with the deepest liquidity, but the one offering the richest network of rewards and partnerships.\n\n### What Funds Stablecoin Rewards\n\nWhile credit card rewards are funded by interchange fees and interest income, stablecoins operate on a different basis. Their primary revenue source is the **interest earned on reserve assets,** chiefly cash and short-duration Treasuries. This makes float management the critical lever for reward design as it’s the ultimate source of rewards.\n\nRegulatory clarity here remains murky. Directly passing yield through to holders is restricted under frameworks such as the U.S. GENIUS Act, but issuers have viable workarounds. Rewards can be booked as **marketing expenses** or tied into a brand’s broader loyalty budget, allowing issuers to remain compliant while still sharing economics with users.\n\nBeyond yield on float, partnered brands can also fund rewards based on the economics of how much value the loyalty program drives to a brand.\n\n## **Co-Branded and White-Labeled Stablecoins**\n\nJust as with credit cards, we should expect the rise of **co-branded stablecoins**. Rewards could accrue within a specific brand or company’s loyalty program, tied to balance size, holding duration, or transaction volume, embedding loyalty mechanics directly into money.\n\nImportantly, issuers can also launch **white-labeled stablecoins** for brands that prefer the consumer-facing relationship to dominate. In this case, the issuer recedes into the background while the brand’s loyalty program captures attention and engagement. \n\nStablecoin startups and companies are already experimenting with white labeled stablecoins.\n\nFor example:\n\n* [Agora](https://www.agora.finance/ecosystem), an issuer partnered with Van Eck and State Street, offers white labeled stablecoins for brands, offering them customizability while Agora handles compliance and licensing, with the underlying AUSD coin. \n* [Paxos](https://insights.paxos.com/stablecoinmasterclass-0?) has also launched a white labeled stablecoin as a service product for enterprises looking for a turnkey solution.\n* [M0](https://www.m0.org/) allows developers to develop application-specific stablecoins with extensive customization options as extensions of the M0 stablecoin. M0 stablecoins can tap into the entire liquidity of the M0 network, bypassing the issue of bootstrapping liquidity.\n\n\n\nAll of the aforementioned platforms challenging Circle and Tether are focused on enabling enterprises and brands to issue their own stablecoins, underscoring this customer segment as a key growth opportunity for new entrants in the coming years.\n\nAs we see, stablecoins' flexibility naturally accommodates brands, extending the most effective features of card rewards into **programmable, global money.**\n\nHowever, the adoption of an onchain model will lead to a fusion of crypto culture, further amplifying attention economy dynamics.\n\n# The Attention Economy: Loyalty Meets Culture\n\nAs stablecoins mature, the competitive dynamics of the **attention economy** will increasingly shape adoption. What distinguishes stablecoin loyalty programs from credit card rewards is not just programmability, but **switching costs.**\n\n\n\nCredit cards are sticky because applying is cumbersome, and consumers rarely hold more than a handful. Stablecoins, by contrast, exhibit much less friction. Moving balances from one issuer to another takes only a single onchain transaction. If a competitor offers more compelling rewards or perks, switching is instantaneous. This low barrier makes the market more fluid, which will force issuers and distributors to continuously innovate on loyalty and attention rather than relying on inertia.\n\nIn practice, this will push branded stablecoins to adopt tactics similar to those in memecoin markets: competing for attention, narrative, and cultural resonance. \n\nThe central question becomes: _what association commands the most eyeballs?_ Large corporations will capture share by embedding rewards into their existing ecosystems. But a market segment that remains underdeveloped in the offchain card world, **celebrities and influencers**, is uniquely positioned to thrive in a branded stablecoin paradigm.\n\n## Celebrity Stablecoins\n\nNo one commands attention like global athletes, pop stars, and YouTubers. By launching “celebrity stablecoins,” issuers can partner with figures like Lebron James, Taylor Swift, or Mr. Beast, aligning incentives for everyone involved. The issuer gains float and distribution, the celebrity deepens fan engagement while receiving a share of float yield, and consumers receive tangible perks. \n\nFor example, holding a Taylor Swift Dollar Coin (TSDC) could unlock exclusive concert tickets, merch, or airdrops. Because wallet activity is visible, partners such as Spotify or guitar manufacturers could target offers directly to Swift’s fan base, layering additional value onto the same loyalty rails. Smaller brands with less recognition could piggyback on these celebrity ecosystems, reaching audiences they could never build alone.\n\n\n\nUnlike creator tokens or celebrity memecoins, **celebrity stablecoins avoid reputational risk.** Their value is stable; fans don’t lose money when prices crash. Rewards are framed as loyalty benefits rather than speculative bets, making them intuitive and consumer-friendly. Issuers can even share a portion of float revenue with celebrities, structured as marketing or licensing fees, further aligning incentives. \n\n\n\nFrom a policy perspective, every celebrity stablecoin is still a U.S. dollar at its core, meaning each one expands dollar dominance globally. For regulators, that outcome strengthens U.S. monetary reach while allowing issuers to capture market share through cultural distribution.\n\nIn this model, money itself becomes a **canvas for culture.** Stablecoins are no longer interchangeable commodities; they are differentiated loyalty containers competing for attention in the same way brands and influencers compete for relevance today.\n\n## The Path to Branded and Celebrity Stablecoins\n\nIf **loyalty and attention** emerge as the true bottlenecks, the key questions become _when_ this transition will occur and _which issuers or partners_ are best positioned to capture it.\n\n### The Role of New Market Entrants\n\nIf traditional financial institutions were the only players entering the stablecoin market, the transition to branded stablecoins would likely be slow, or might not occur at all. Banks are culturally conservative and have little incentive to experiment with consumer-facing loyalty mechanics beyond existing credit card programs.\n\nBy contrast, **Big Fintech** and **crypto-native companies** have proven track records in user acquisition, gamified design, and rapid iteration. They are comfortable competing on the basis of attention and loyalty in ways banks are not.\n\n#### **Robinhood**\n\n[Robinhood](https://messari.io/project/robinhood-exchange) illustrates this dynamic. The company made its name by pioneering commission-free trading, [gamifying](https://finmasters.com/gamification-of-investing/#gref) the brokerage experience, and offering bold retail-facing products like options. It embraced crypto early, listing [Bitcoin and Ethereum](https://www.cnbc.com/2018/01/25/stock-trading-app-robinhood-to-roll-out-bitcoin-ethereum-trading.html#:~:text=Stock%20trading%20app%20Robinhood%20is,in%20February%2C%20Robinhood%20announced%20Thursday.) in February 2018 and entering the memecoin space with [Dogecoin](https://newsroom.aboutrobinhood.com/dogecoin-is-now-on-robinhood-crypto/) in July of the same year.\n\n\n\nToday, Robinhood is doubling down on crypto with the announcement of the [Robinhood](https://messari.io/report/robinhood-chain-three-key-takeaways)[ ](https://messari.io/report/robinhood-chain-three-key-takeaways)[Chain](https://messari.io/report/robinhood-chain-three-key-takeaways), a layer-2 (L2) built with [Arbitrum](https://messari.io/project/arbitrum), and the expansion of its crypto footprint. \n\nRobinhood’s DNA, retail-first, crypto-friendly, and attention-driven, makes it a natural candidate to experiment with branded or celebrity stablecoins. Given that its CEO, Vlad Tenev, [stated](https://x.com/vladtenev/status/1942632139503116622) that “tokenization is the greatest innovation in capital markets since the central limit order book,” we expect ambitious strategies to be implemented to win market share, and celebrity stablecoins would be far from the boldest move they’ve made.\n\n#### **Stripe and Coinbase**\n\nOther fintechs are moving in similar directions. Stripe launched stablecoin financial accounts across [101 countries in mid-2025](https://stripe.com/blog/introducing-stablecoin-financial-accounts), powered by Bridge, and is reportedly building a [Layer-1 (L1), “Tempo,”](https://cryptobriefing.com/stripe-builds-tempo-blockchain-paradigm/) in partnership with Paradigm. While less bold in targeting retail than Robinhood, Stripe would likely not hesitate to compete head-on with branded stablecoins to stay competitive due to its focus on execution and what works.\n\nCoinbase has aggressively expanded its infrastructure footprint with the launch of **Base**, while signaling ambitions to build an “[everything app](https://www.cnbc.com/2025/07/16/coinbase-steps-into-consumer-market-with-stablecoin-powered-everything-app-that-goes-beyond-trading.html)” integrating stablecoins, tokenized stocks, and DEX integrations. As it attempts to compete with players like Robinhood entering crypto from fintech, it will need to compete on all major fronts, and branded stablecoins would certainly not be off the table.\n\nThe intense competition emerging from the TAM and profitability of stablecoins is likely to push tech-savvy giants in fintech and crypto to pursue ambitious strategies to win market share, increasing the likelihood of branded stablecoins and even celebrity stablecoins reaching the mass market.\n\n#### **Well-Backed Startups**\n\nAs discussed above, startups like **Agora** and **M0** are already developing white-labeled solutions for third-party brands and companies. As the competitive frontier shifts toward loyalty and attention, these firms, still in search of product-market fit, are likely to lean harder into branded stablecoins as a natural extension of their core strategy.\n\n#### **Pressure on Incumbents**\n\nThe presence of such ambitious challengers is also pressuring incumbents such as Tether, Circle, and Paxos. Circle has shown urgency with the launch of its own L1, [Arc](https://www.circle.com/blog/introducing-arc-an-open-layer-1-blockchain-purpose-built-for-stablecoin-finance), highlighting the risk that neutral issuers face commoditization if they only compete on existing paradigms rather than move fast in response to competition.\n\n\n\n### Branded Stablecoin Outlook\n\nTaken together, the competitive picture is clear. As fintechs, crypto platforms, and startups compete to capture stablecoin economics, their track records of bold product launches suggest that **branded tokens and celebrity stablecoins will arrive faster than most expect.** The pace of competition will also force incumbents like Circle and Tether to adapt, shifting their own product strategies in a market where culture and loyalty, not just liquidity and compliance, determine adoption**.**\n\nThe open questions are when they arrive and which combination of issuers, fintechs, brands, and celebrities will define the category.\n\n## Branded RWAs and Hyper-Tokenization\n\nLooking further ahead, the same dynamics that make loyalty-linked stablecoins and celebrity-branded tokens compelling could extend into RWAs as tokenization matures. The combination of programmable loyalty mechanics and attention-based economics will not be confined to payments. Over time, it may apply to a broad range of tokenized assets.\n\nConsider a world where Apple stock or 10-year U.S. Treasuries exist at scale as tokenized instruments. In such a scenario, we could plausibly see products like _Taylor Swift Apple (TsAAPL)_ or _MrBeast 10YR_, wrappers that bundle mainstream financial products with the loyalty hooks and cultural cachet of a celebrity or brand. Just as with stablecoin issuers, tokenized asset issuers could create white labeled or co-branded tokens to increase attention. These instruments would not replace the underlying assets. Instead, they would serve as distribution layers that differentiate commoditized financial exposure through consumer engagement, perks, and brand alignment as all assets make their way onchain.\n\nTo be clear, this scenario requires significant infrastructure buildout, regulatory clarity, and cultural acceptance. Tokenization of RWAs remains in its early innings. BlackRock’s BUIDL fund surpassed [$2.3B in AUM](https://app.rwa.xyz/treasuries), and Franklin Templeton’s tokenized money market fund crossed [$750M](https://app.rwa.xyz/treasuries), but these remain small fractions of global financial flows. Regulatory frameworks could also evolve in ways that restrict branded overlays. For example, it is entirely plausible that U.S. regulators draw a hard line between tokenized Treasuries as institutional instruments and consumer-facing loyalty mechanics layered on top. In the near term, such restrictions may even be the base case.\n\nStill, the playbook is already visible. If celebrity stablecoins demonstrate that loyalty + attention can drive adoption in a commoditized category like money, it is only natural that the same model would be applied to tokenized equities, treasuries, real estate, and other RWAs once the rails are in place. Financial products long treated as purely functional could be reimagined as distribution contests layered with cultural identity and loyalty economics**.**\n\nThe broader lesson is that user-facing design can redefine categories once assumed to be interchangeable. Stablecoins will show this first, but tokenized RWAs could follow a similar arc: from unbranded utilities to branded experiences, where culture determines who wins market share.\n\n## Conclusion\n\nThis report highlights where the next competitive bottleneck will emerge in the stablecoin and broader tokenization markets. Over the next 3-5 years, competition is likely to shift from distribution, already well underway, to loyalty and attention, where branded and celebrity stablecoins will become the decisive battleground. Stakeholders that begin preparing for this transition now, through strategic partnerships, early experiments in loyalty design, and organizational readiness to move quickly, will be positioned to separate themselves from slower-moving incumbents and TradFi entrants.\n\nWinning distribution today is necessary, but it is **not sufficient.** The deeper challenge is anticipating what comes next: the fusion of crypto-native culture with traditional financial assets, and eventually the rise of branded RWAs**.**\n\nImportantly, the current U.S. administration has signaled a more favorable stance toward crypto innovation, creating an environment where **boldness, not caution, is rewarded.** The blending of memetic cultural distribution engines with financial utility is likely to define the next adoption wave. \n\nThe lesson is simple: do not assume that TradFi will simply impose its systems and values on crypto. Historical transitions are never that straightforward. Instead, we should expect a **two-way exchange**, where crypto-native culture, community, and design reshape how traditional assets are packaged, distributed, and competed over. The winners of the tokenization era will be those that recognize this dynamic early and align their strategies accordingly.",

"hook": "This report examines how stablecoin competition is moving beyond distribution toward loyalty and attention, arguing that branded and celebrity stablecoins, and eventually branded RWAs, will define the next phase of tokenization.",

"publishDate": "2025-08-22T17:21:00Z",

"readingTimeInMinutes": 15.331666666666667,

"slug": "beyond-the-stablecoin-distribution-bottleneck-branded-stablecoins-loyalty-programs-the-attention-economy-celebrity-stablecoins-and-the-convergence-of-tradfi-fintech-and-crypto",

"subscriptionTier": "enterprise",

"summary": "This report explores how stablecoin competition is shifting beyond distribution toward loyalty and attention as the decisive drivers of adoption. Drawing lessons from the history of credit cards, it argues that branded and celebrity stablecoins will emerge as the next stage of differentiation, extending into co-branded and white-labeled tokens. The analysis also considers the eventual rise of branded RWAs, where tokenized assets are reimagined through cultural and loyalty overlays. Stakeholders are urged to prepare now for this transition, as the fusion of crypto-native culture with traditional finance will reshape the trajectory of tokenization.",

"tags": [

{

"id": "b91556d7-765c-4b98-b11f-665485c2d908",

"name": "Stablecoins"

},

{

"id": "3cf4ee65-4f37-4130-9bb6-5a899a64fb68",

"name": "Memecoins"

},

{

"id": "9a329d89-97bb-4b33-a1a4-2cb0e3d63afe",

"name": "Tokenomics"

},

{

"id": "50fa434c-ec22-4af1-940e-0c140864a22c",

"name": "Web3"

},

{

"id": "8ef53cf6-d66a-48e3-bf0d-03da8cfdca14",

"name": "Consumer"

}

],

"title": "Beyond the Stablecoin Distribution Bottleneck: Branded Stablecoins, Loyalty Programs, the Attention Economy, Celebrity Stablecoins, and the Convergence of TradFi, Fintech, and Crypto."

},

{

"id": "21fed96f-3bdf-4bf5-8bed-08e4659f2aff",

"createdAt": "2025-01-24T05:42:19Z",

"updatedAt": "2025-01-24T15:06:42Z",

"assetIds": [

"bcbe9ab0-8a03-4295-bd4c-5e4d7caf1026",

"7e532302-9ced-4e90-8c8a-218a38e1dbba"

],

"assets": [

{

"id": "bcbe9ab0-8a03-4295-bd4c-5e4d7caf1026",

"name": "Official Trump",

"symbol": "TRUMP",

"slug": "official-trump"

},

{

"id": "7e532302-9ced-4e90-8c8a-218a38e1dbba",

"name": "Melania Meme",

"symbol": "MELANIA",

"slug": "melania-meme"

}

],

"authors": [

{

"id": "2a49c71e-ac60-4630-a145-f16bec762ed0",

"name": "Sunny Shi",

"image": "https://cdn.sanity.io/images/2bt0j8lu/production/fcf26337bf630d89555757f090a2e4fd15b742ca-256x256.webp?w=100",

"linkedinUrl": ""

},

{

"id": "ee645061-729f-49c2-96ff-4aaf1eb62050",

"name": "Kinji Steimetz",

"image": "https://cdn.sanity.io/images/2bt0j8lu/production/3b1398c35274334eacecb25fdf6931db9ae91634-512x512.png?w=100",

"linkedinUrl": ""

},

{

"id": "f69a6e38-eed2-489d-956f-df03541a8992",

"name": "Andrew Dyer",

"image": "https://cdn.sanity.io/images/2bt0j8lu/production/3a0449c1821215d1e1ae17854c948390115d5a04-511x512.png?w=100",

"linkedinUrl": ""

},

{

"id": "6a7f467f-5dbf-4ba5-a8b4-499af94fd2c4",

"name": "Dylan Bane",

"image": "https://cdn.sanity.io/images/2bt0j8lu/production/db9a9c7bcea81c62c3ebabff017525acf5bf7bd3-772x780.png?w=100",

"linkedinUrl": ""

}

],

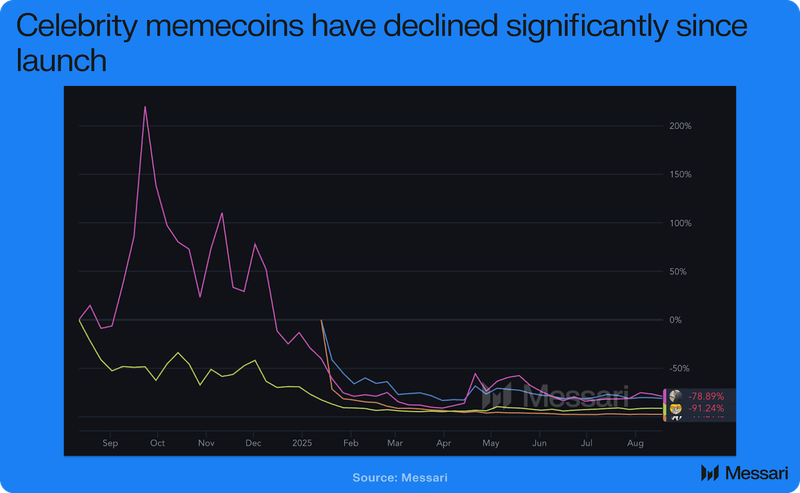

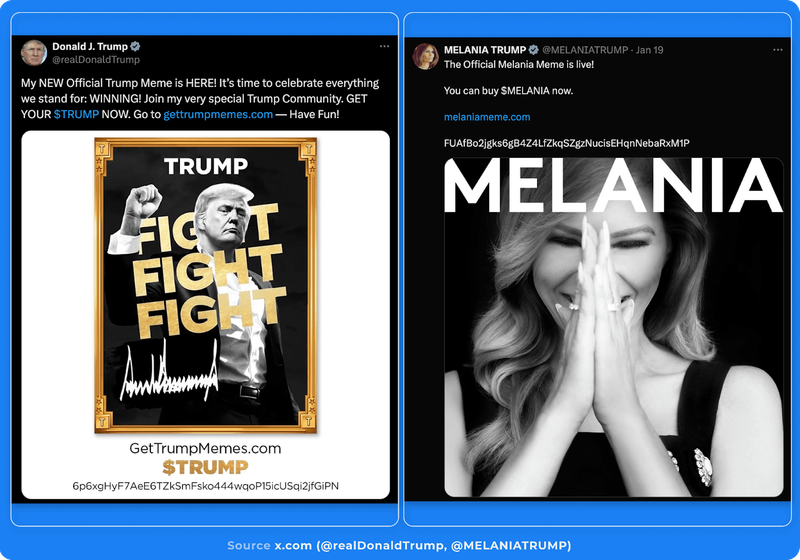

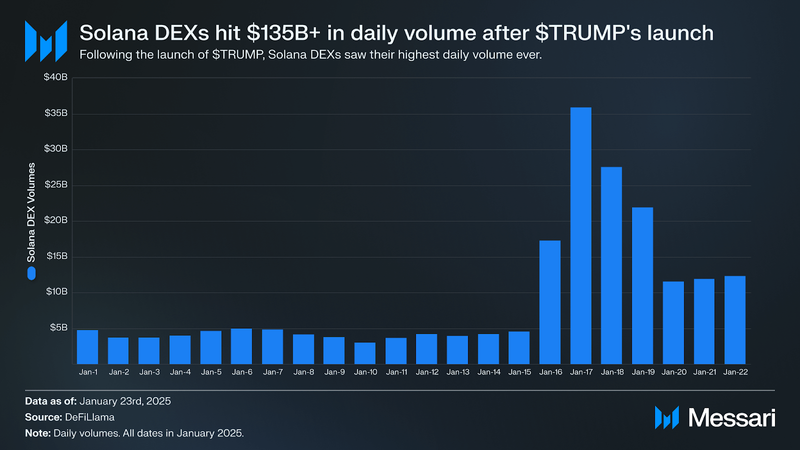

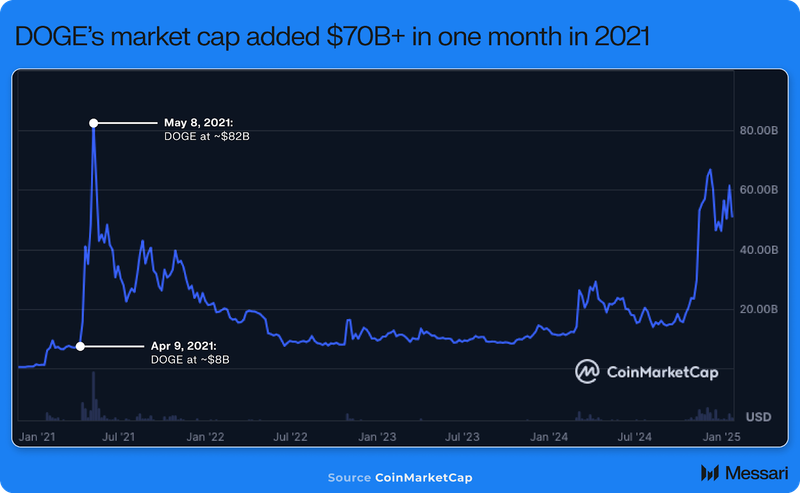

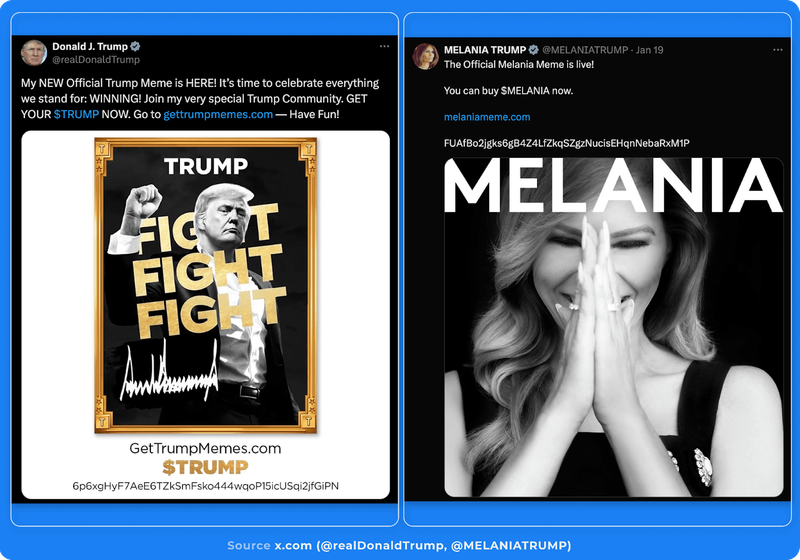

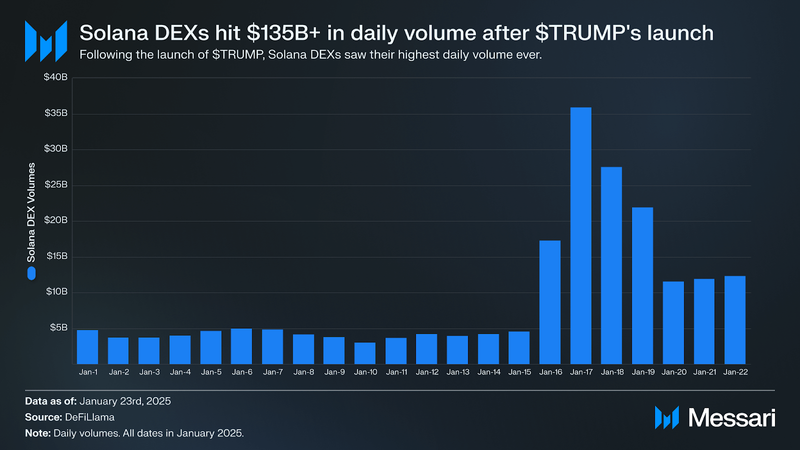

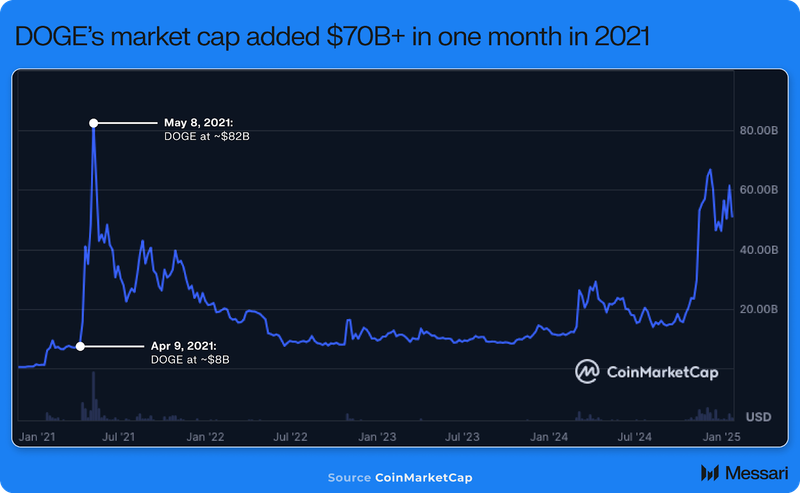

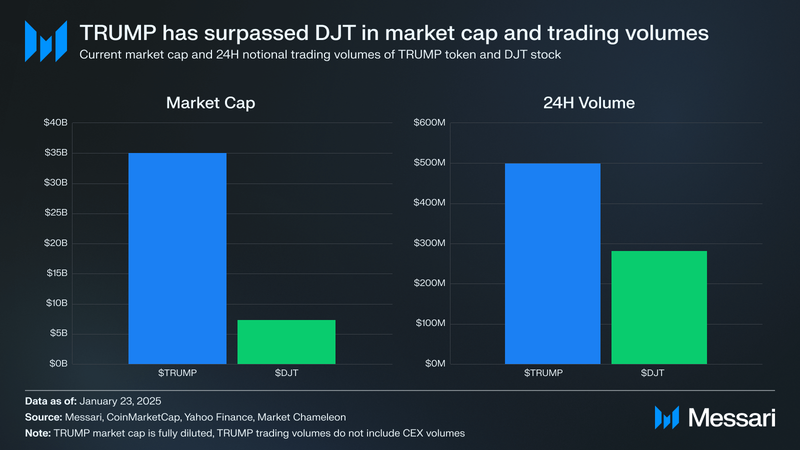

"content": "On January 17th, President Donald Trump launched a memecoin on Solana,[ $TRUMP](https://messari.io/project/official-trump), which quickly reached a peak valuation of $76 billion within 48 hours. The surge was cut short when the First Lady launched her own token, [$MELANIA](https://messari.io/project/melania-meme), on January 19th. The new token pulled liquidity from $TRUMP, causing its price to drop from around $75 to $30 in under an hour.\n\n\n\nBeyond the price movement, the launch had a broader impact on the crypto market. Solana recorded its highest daily DEX volume, with [DeFiLlama](https://defillama.com/dexs/chains/solana) reporting $85 billion in trading, though many users reported network congestion and failed transactions. [Moonshot reportedly onboarded over 400,000](https://x.com/moonshot/status/1880783442243416505) users in less than 24 hours, marking one of the largest single-day influxes of new participants onchain.\n\n\n\nThe response has been mixed. Some see it as a sign of growing adoption, with a U.S. president launching a token onchain and driving new user activity. Others point to the token’s distribution, with the Trump administration appearing to control 80% of the supply, raising concerns about insider allocations. The locked tokens are distributed across six entities, labeled “Creators and CIC Digital 1-6,” with lock-up periods ranging from 3 to 12 months. After this period, an initial unlock of either 10% or 25% will occur, followed by gradual daily releases over two years.\n\nWith the dust settling, the focus shifts to what this means for broader market dynamics and whether it signals a lasting shift or just another short-lived cycle.\n\n### Sunny Shi ([@defi_monk](https://x.com/defi_monk))\n\nThe launch and subsequent market reaction to the $TRUMP coin can be seen as a \"pull forward\" event, providing valuable insight into the trajectory and potential length of the current crypto cycle. Simultaneously, the token’s meteoric rise underscores the cumulative progress made by the crypto industry—and Solana specifically—over the past few years. This development signals a remarkably bullish outlook for the future of blockchains as places to trade anything, anywhere, at any time.\n\n\n\n$TRUMP has rapidly pulled forward a significant amount of retail adoption overnight. The move is reminiscent of the $70B+ of market cap that DOGE added in April of 2021, which was one of the largest crypto onboarding catalysts that ever occurred. With over 400,000 new downloads of Moonshot (which was [listed](https://gettrumpmemes.com/) on the memecoin’s website as a trading venue for the token), it appears as if this time, the retail bid came through. While many of these new entrants may remain engaged in trading crypto, it’s worth noting that DOGE’s explosive rise in 2021 marked the later stages of that cycle, as it condensed months of gradual user acquisition into a singular, concentrated event.\n\nMany on crypto twitter have lamented the continued resilience of memecoins and their trading activity, probably because the “Solana Casino” is comparatively less compelling than more innovative sectors like DeFi. However, this phenomenon ultimately reflects the growing demand for blockspace, driven by advancements in execution environments like Solana, which offer faster and more affordable access to that blockspace. This marks a significant victory for Solana, which recorded over $1 billion in $TRUMP-related [volume](https://x.com/CSURAM88/status/1880477851738378738) within the first three trading hours and saw $80B in market cap generated in less than 24 hours. Also of note, Hyperliquid was able to [list](https://x.com/stevenyuntcap/status/1880652922289336830) liquid TRUMP perps [within](https://x.com/HyperliquidX/status/1880486665460019356) a few hours of the coin launching, highlighting how quickly onchain protocols can spin up liquid markets to capitalize on speculation. \n\n\n\nRemarkably, $TRUMP is trading at a higher valuation and is generating more volume than the Trump Media & Technology Group ([DJT](https://finance.yahoo.com/quote/DJT/?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAABLOPLKe_82TakWpYW_8vcFHoWkYEZ2TugF_yTI84HvneT-oexZHlRthK6kPiyqpF-hq8wLo7AS-Iu2Ig1K5yQNhDRWeExACtx5MXe50DcHSVW9D4k0BzegO2VInsM_GoBKoXGJLwI3jOHnZ6Xnh3IchMYC1qYFxclcDkBrQ_kGm)), which has historically been the primary speculative asset tied to Trump’s influence. If the future of trading lies onchain, this event serves as compelling evidence that the industry is moving in the right direction.\n\n### Kinji Steimetz ([@SteimetzKinji](https://x.com/SteimetzKinji))\n\nThe launch of $TRUMP is more than just another meme coin—it’s a financial manifestation of the Trump administration’s positive stance toward crypto. Having a sitting president effectively endorse and launch a token signals a stark shift in policy from the previous administration, marking what appears to be a full embrace of onchain digital assets. While the short-term market impacts remain uncertain, it’s hard to ignore the broader implications. This isn’t just regulatory chatter or campaign rhetoric; it’s a direct move into the crypto space, signaling a government that, at least for now, sees value in fostering digital asset creation.\n\nThat said, winning this battle doesn’t mean the war is over. The launch of $TRUMP—and now $MELANIA—also reveals a counter-narrative. It suggests that this administration, while currently aligned with crypto’s interests, is ultimately driven by opportunism rather than any deep ideological commitment to decentralization or financial sovereignty. Right now, the incentives are aligned, and crypto benefits from Trump’s willingness to lean into it. But if that alignment shifts—whether due to policy priorities, shifting political landscapes, or succession planning—crypto could just as easily find itself back on the chopping block.\n\nThis administration isn’t championing crypto because it believes in its core principles; it’s leveraging crypto because it’s politically expedient. That distinction matters. It means there’s an increased risk of extractive behavior, where crypto is embraced only as long as it serves a political purpose. The concern isn’t immediate, but it’s worth keeping in mind that the same administration that is currently fueling optimism could just as easily turn predatory if the incentives no longer align. \n \nCrypto may be in the spotlight now, but at some point in the next four years…. \n\n\n\n\n### Dylan Bane ([@dylanebane](https://x.com/dylangbane)) \n\nThe TRUMP and MELANIA token launches serve as a fitting prelude to the next 4 years of crypto under the Trump Administration–chaos. Trump’s first term was marked by unpredictability, sensationalism, and a virtual monopoly on media attention. With crypto, Trump has perhaps found perfect personality-market fit, with the potential to hyper-financialize Trump’s talent of owning narratives and controlling the attention market’s center stage. \n\nTrump has good reason to take advantage of crypto to rapidly increase his liquid assets. Over the course of his presidential campaign, Trump faced fines exceeding [$500 million in a Civil Suit](https://www.cbsnews.com/news/trump-new-york-fraud-case-502-million-inauguration/), putting at risk the entirety of his liquid holdings. While Trump’s net worth [fluctuated between $3-$8 billion](https://www.cbsnews.com/news/trump-new-york-fraud-case-502-million-inauguration/) in the last year, much of this wealth is tied up in TMTG stock subject to vesting periods, intangible brand value, and illiquid real estate—leaving him vulnerable to a cash crunch.\n\nThe launch of the TRUMP token dramatically altered this landscape. Within a single day, Trump’s net worth reportedly surged tenfold to over $60 billion, with the token comprising as much as 90% of his wealth. Publicly, Trump has downplayed the significance of this windfall, calling his newfound billions as [“peanuts to these guys,”](https://www.bbc.com/news/articles/crlkjejpwr8o) in reference to the tech titans shaping AI policy in his administration. However, the prominence of the token launches across Trump’s social media and the active involvement of his three sons—who are spearheading projects like the World Liberty Financial DeFi platform—signal that the former president is taking crypto seriously behind the scenes.\n\nTrump now knows he can singlehandedly drive crypto’s “trenches” without meaningful repercussions. In an industry driven by narratives and mindshare, the markets could be at Trump’s mercy for the next 4 years, with random token launches, exaggerated policy promises, and sudden crypto policy advisor reshufflings. Just take the impromptu launch of the MELANIA token which triggered an immediate sell-off in AI tokens and memecoins, while also straining foundational blockchain infrastructure on Solana. Similar events could occur regularly over the next 4 years.\n\nThis state of affairs creates an interesting situation where majors and institutionally approved tokens will likely stand to gradually benefit from pro-crypto regulation and close industry relationships with Trump, while low-market cap tokens in the “trenches” that appeal mostly to retail will react violently to any of Trump’s actions. Such tokens appealing to retail are now subject to even more volatility and risk with potential blackhole liquidity events happening at any time due to Trump. How Trump’s unique personality combined with his embracement of crypto will affect markets will almost certainly create situations in the crypto markets that we’ve never seen before.\n\nWhether tying the fate of memecoins and retail favorites to the capriciousness of Trump’s second term ends up benefiting the industry remains to be seen.\n\n### Andrew Dyer ([@0xSynthesis1](https://x.com/0xSynthesis1))\n\nThere’s a version of the universe out there where MELANIA never launched, TRUMP went to $100, and the new users onboarded through venues like Moonshot went on to invest even more in crypto after a good first trade. Instead, the second launch soured sentiment, siphoned liquidity from 95% of tokens, and mostly confused participants as to the market’s next move. The event largely interrupted the strong momentum the agent vertical was experiencing, and now people seem unsure of what the dominant meta to allocate to is. But given no other meta has emerged as a forerunner, and AI more generally is probably still the most interesting sector to build around, I think capital flows back there after BTC finds its footing.\n\nFor as much as we might hone in on this event as a significant retail onboarding event, we may want to think about how impactful that is on a relative basis. It was [noted](https://x.com/JasonYanowitz/status/1882238816507089220) that some 80%+ of TRUMP holders hold less than $1000 worth of assets in their individual wallets. 400,000 new people onchain bringing $1000 of fresh capital into the ecosystem… is less than half of the [inflows](https://farside.co.uk/btc/) (~$800M) the BTC ETFs received on the 21st. In that sense, TRUMP is more relevant for onchain flows for short-term traders, but probably inconsequential for the flows that will move the entire market. Given we’re already seeing a new [task force](https://www.sec.gov/newsroom/press-releases/2025-30) led by crypto-friendly regulators, the [repeal](https://www.coindesk.com/policy/2025/01/23/sec-withdraws-controversial-crypto-tax-accounting-bulletin) of SAB-121, and a new working [group](https://www.banking.senate.gov/newsroom/majority/scott-applauds-president-trumps-executive-order-to-create-working-group-on-digital-asset-markets) led by Senator Lummis, the changes that are needed to bring large additional flows into the market in the medium-term are already underway.",

"hook": "Trump’s memecoin launch sent Solana trading to record highs—but what does it mean for the broader crypto market?",

"publishDate": "2025-01-24T12:45:51.361Z",

"readingTimeInMinutes": 8.344444444444445,

"slug": "analyst-discussion-usdtrump-and-usdmelania",

"subscriptionTier": "pro",

"summary": "Our analysts break down the launch of $TRUMP and $MELANIA, their impact on Solana’s record $85 billion DEX volume, and the market’s reaction. While some view this as a major milestone for crypto adoption, concerns over insider allocations and political opportunism remain. The event also raises questions about long-term market trends, the role of memecoins, and how Trump’s engagement with crypto might shape the industry over the next four years.",

"tags": [

{

"id": "3cf4ee65-4f37-4130-9bb6-5a899a64fb68",

"name": "Memecoins"

}

],

"title": "Analyst Discussion: $TRUMP & $MELANIA"

}

],

"metadata": {

"limit": 10,

"page": 1,

"totalRows": 2,

"totalPages": 1

}

}Research

Get research reports

Returns a list of research reports based on filters like asset ID and tags

GET

/

research

/

v1

/

reports

Get research reports

Copy

Ask AI

curl --request GET \

--url https://api.messari.io/research/v1/reports \

--header 'X-Messari-API-Key: <api-key>'Copy

Ask AI

{

"error": null,

"data": [

{

"id": "3f9ff008-a798-4f6e-85c7-a6a109e8832c",

"createdAt": "2025-08-22T16:52:34Z",

"updatedAt": "2025-10-17T17:23:12Z",

"assetIds": [

"4515ba15-2719-4183-b0ca-b9255d55b67e",

"51f8ea5e-f426-4f40-939a-db7e05495374",

"ad1342eb-a5fe-4c60-b37e-71a8859f0fea",

"784b12bc-b284-4689-9b97-8ea7fec440ba",

"bcbe9ab0-8a03-4295-bd4c-5e4d7caf1026"

],

"assets": [

{

"id": "4515ba15-2719-4183-b0ca-b9255d55b67e",

"name": "USDC",

"symbol": "USDC",

"slug": "circle-usdc-stablecoin"

},

{

"id": "51f8ea5e-f426-4f40-939a-db7e05495374",

"name": "Tether",

"symbol": "USDT",

"slug": "tether"

},

{

"id": "ad1342eb-a5fe-4c60-b37e-71a8859f0fea",

"name": "Pax Dollar",

"symbol": "USDP",

"slug": "pax-dollar"

},

{

"id": "784b12bc-b284-4689-9b97-8ea7fec440ba",

"name": "Agora Dollar",

"symbol": "AUSD",

"slug": "agora-dollar"

},

{

"id": "bcbe9ab0-8a03-4295-bd4c-5e4d7caf1026",

"name": "Official Trump",

"symbol": "TRUMP",

"slug": "official-trump"

}

],

"authors": [

{

"id": "6a7f467f-5dbf-4ba5-a8b4-499af94fd2c4",

"name": "Dylan Bane",

"image": "https://cdn.sanity.io/images/2bt0j8lu/production/db9a9c7bcea81c62c3ebabff017525acf5bf7bd3-772x780.png?w=100",

"linkedinUrl": ""

}

],

"content": "## Introduction\n\nStablecoin adoption has advanced from serving as crypto-native financial primitives to powering mainstream payments.\n\nWith the passage of stablecoin regulation in the U.S. (e.g., [GENIUS Act](https://www.congress.gov/bill/119th-congress/senate-bill/394/text)), the entrance of new issuers from [Big Fintech](https://www.reuters.com/technology/crypto-firms-including-robinhood-kraken-launch-global-stablecoin-network-2024-11-04/) and [TradFi](https://www.cnbc.com/2025/06/17/jpmorgan-stablecoin-jpmd.html), and public equities increasingly [assigning a premium](https://fortune.com/2025/06/10/circle-ipo-stock-price-valuation-outlook/) to stablecoin-linked businesses, developing a long-term thesis on the trajectory of stablecoins and tokenization is essential for both crypto-native stakeholders and financial professionals.\n\n\n\nToday, market participants remain focused on the current competitive battleground: **distribution.** Control of on- and off-ramps, exchange listings, wallet integrations, liquidity depth, and merchant acceptance determines who wins share in the short term. Yet this view is incomplete. Once distribution consolidates around a handful of long-term incumbents, the locus of competition will shift.\n\nThis report argues that the **next differentiators** will be:\n\n* **Loyalty** – programmable, onchain rewards that resemble but surpass traditional credit card points. \n\n* **Attention** – the cultural and celebrity reach that determines which brands capture consumer mindshare.\n\nTogether, these forces will shape the next phase of the “stablecoin wars.”\n\nIn addition, we advance the thesis that **Branded Stablecoins** and, over time, **Branded RWAs** in the form of co-branded or white-labeled tokens representing offchain assets, will be the natural evolution of this market. These instruments will not only secure user loyalty but also channel cultural capital into financial adoption. Investors, issuers, and partners who fail to account for this shift in their tokenization outlook risk underestimating the future bottlenecks of competition.\n\n## Stablecoin Economics and the Limits of Distribution\n\nStablecoins offer one of the most attractive business models in the world. Issuers earn risk-free yield on the float of cash and Treasury bills backing their tokens. At current supply levels (just over [$250 billion](https://messari.io/report-pdf/b712a2f7e09bdd7925df633589d48f2b0ce769ac.pdf) as of mid-2025) and prevailing yields (around 5%), annualized revenue exceeds $12 billion across issuers. \n\nDue to the size of the opportunity, large established companies in TradFi, fintech, and crypto are actively entering the market, which is currently dominated by two large incumbents, [Tether](https://messari.io/project/tether) and [Circle](https://messari.io/project/circle-usdc), which account for a [combined 85% of stablecoin market share](https://messari.io/report-pdf/b712a2f7e09bdd7925df633589d48f2b0ce769ac.pdf).\n\n\n\nBut money is a commodity. A dollar issued by Circle, PayPal, or JPMorgan remains just a dollar. As regulatory standards crystallize, the main competitive fight is over distribution, on-ramps, exchange listings, wallet integrations, merchant acceptance, and the like. Indeed, distribution is so critical that Circle gives up [~61% of its yield](https://www.businesswire.com/news/home/20250812836620/en/Circle-Reports-Second-Quarter-2025-Results) on float to platforms like Coinbase.\n\nDistribution will be critical, and may, indeed, be the primary driver of market share early on. But issuers that fail to win on distribution will quickly look for alternative levers. \n\nTwo areas stand out: **loyalty** (programmable onchain rewards) and **attention** (brand + celebrity reach).\n\n## Lessons from Credit Cards: Distribution, Adoption, and Loyalty\n\nTo understand why, the evolution of credit cards can point us in the right direction.\n\nIn the early decades of credit cards, merchant acceptance defined the competitive battleground**.** A card’s utility depended entirely on where it could be swiped, so issuers raced to build the [broadest possible network](https://finanso.com/us/blog/when-were-credit-cards-invented-the-history-of-credit-cards/?utm_source=chatgpt.com) of participating merchants. Without that foundation, consumer demand could not be unlocked. The first problem to solve was the scale of usage.\n\n\n\nOnce merchant acceptance reached critical mass, competition shifted to **mass consumer adoption.** Banks and card networks marketed credit cards as safer and more convenient than cash, emphasizing fraud protection and ease of use. Direct mail campaigns, aggressive sign-up bonuses, and generous credit lines pulled [millions of new users](https://worldhistoryjournal.com/2025/06/22/credit-card-history/?utm_source=chatgpt.com) into the system. By the 1970s and 1980s, carrying a credit card was no longer novel; it was the norm for the American middle class.\n\nWith both sides of the network in place, issuers needed a new lever to differentiate themselves. This is where **points and loyalty programs** emerged as the defining edge. The 1981 Citibank-American Airlines partnership pioneered the model, showing that a card could offer more than credit; it could offer [rewards](https://www.ft.com/content/85ddff1e-9552-4ff9-ae59-b688e2984d20?utm_source=chatgpt.com)**.** Airline miles, and later cashback programs, created a new layer of competition: not just who had the broadest merchant network or best introductory offer, but who could connect spending to a broader lifestyle.\n\n\n\nRewards reshaped consumer behavior because they shifted the frame of reference. Spending on a particular card wasn’t just a transaction; it was progress toward a free flight, a hotel stay, or cash back. This made [usage habitual](https://www.businessinsider.com/airlines-credit-cards-loyalty-miles-rewards-profits-delta-united-american-2025-5?), not occasional, and cemented credit cards as the dominant consumer payment rail.\n\nEven today, rewards remain one of the most powerful differentiators. Roughly [60% of U.S. consumers](https://www.ipsos.com/en-us/majority-say-credit-card-rewards-are-very-important-and-drive-their-card-usage) say rewards are very important in their choice of credit card, and [49% report they would switch cards](https://www.ipsos.com/en-us/majority-say-credit-card-rewards-are-very-important-and-drive-their-card-usage) if a better rewards program were available. For partnered companies, loyalty economics can be even more lucrative. Delta’s co-branded credit card program with American Express generated **$6.8 billion in revenue in 2023**, accounting for [70% of the airline’s total profit](https://www.ft.com/content/d9121c2e-0444-4f33-86fb-36d34c68c228?utm_source=chatgpt.com).\n\nAltogether, the credit card industry demonstrates that loyalty programs are a **three-way win**: compelling for issuers, sticky for consumers, and immensely valuable for partners.\n\nThe historical progression, distribution, adoption, and then loyalty, offers a playbook for how today’s stablecoin issuers may compete once distribution consolidates.\n\n## Onchain loyalty programs \n\n### A Broader Design Space\n\nOnchain loyalty unlocks a much broader design space than traditional card programs. Consumers can **selectively share verified payment histories** with third parties, enabling new forms of personalized rewards. A traveler who spends heavily on international flights, for example, could prove that pattern onchain and receive tailored offers from luxury retailers or hospitality partners. Because payment activity is transparent and verifiable, issuers and brands can build **composable loyalty programs** that maximize consumer value in ways legacy systems cannot match.\n\nWe’re already seeing this model in action. [Blackbird](https://messari.io/report/blackbird-fly-blackbird-fly-a-model-for-web3-loyalty-programs), an onchain restaurant discovery and loyalty platform, gives restaurants access to customer dining data and visit histories. In exchange for data sharing, restaurants provide personalized incentives that deepen relationships, increase repeat visits, and maximize diner LTV. For an industry with razor-thin margins, such programs can be the most effective lever for revenue and profitability.\n\n\n\nStablecoins extend the same principle at a global scale. As issuers and partners look beyond distribution, they will compete by embedding **programmable loyalty features directly into the currency itself.** In this model, the “best” stablecoin is not only the one with the deepest liquidity, but the one offering the richest network of rewards and partnerships.\n\n### What Funds Stablecoin Rewards\n\nWhile credit card rewards are funded by interchange fees and interest income, stablecoins operate on a different basis. Their primary revenue source is the **interest earned on reserve assets,** chiefly cash and short-duration Treasuries. This makes float management the critical lever for reward design as it’s the ultimate source of rewards.\n\nRegulatory clarity here remains murky. Directly passing yield through to holders is restricted under frameworks such as the U.S. GENIUS Act, but issuers have viable workarounds. Rewards can be booked as **marketing expenses** or tied into a brand’s broader loyalty budget, allowing issuers to remain compliant while still sharing economics with users.\n\nBeyond yield on float, partnered brands can also fund rewards based on the economics of how much value the loyalty program drives to a brand.\n\n## **Co-Branded and White-Labeled Stablecoins**\n\nJust as with credit cards, we should expect the rise of **co-branded stablecoins**. Rewards could accrue within a specific brand or company’s loyalty program, tied to balance size, holding duration, or transaction volume, embedding loyalty mechanics directly into money.\n\nImportantly, issuers can also launch **white-labeled stablecoins** for brands that prefer the consumer-facing relationship to dominate. In this case, the issuer recedes into the background while the brand’s loyalty program captures attention and engagement. \n\nStablecoin startups and companies are already experimenting with white labeled stablecoins.\n\nFor example:\n\n* [Agora](https://www.agora.finance/ecosystem), an issuer partnered with Van Eck and State Street, offers white labeled stablecoins for brands, offering them customizability while Agora handles compliance and licensing, with the underlying AUSD coin. \n* [Paxos](https://insights.paxos.com/stablecoinmasterclass-0?) has also launched a white labeled stablecoin as a service product for enterprises looking for a turnkey solution.\n* [M0](https://www.m0.org/) allows developers to develop application-specific stablecoins with extensive customization options as extensions of the M0 stablecoin. M0 stablecoins can tap into the entire liquidity of the M0 network, bypassing the issue of bootstrapping liquidity.\n\n\n\nAll of the aforementioned platforms challenging Circle and Tether are focused on enabling enterprises and brands to issue their own stablecoins, underscoring this customer segment as a key growth opportunity for new entrants in the coming years.\n\nAs we see, stablecoins' flexibility naturally accommodates brands, extending the most effective features of card rewards into **programmable, global money.**\n\nHowever, the adoption of an onchain model will lead to a fusion of crypto culture, further amplifying attention economy dynamics.\n\n# The Attention Economy: Loyalty Meets Culture\n\nAs stablecoins mature, the competitive dynamics of the **attention economy** will increasingly shape adoption. What distinguishes stablecoin loyalty programs from credit card rewards is not just programmability, but **switching costs.**\n\n\n\nCredit cards are sticky because applying is cumbersome, and consumers rarely hold more than a handful. Stablecoins, by contrast, exhibit much less friction. Moving balances from one issuer to another takes only a single onchain transaction. If a competitor offers more compelling rewards or perks, switching is instantaneous. This low barrier makes the market more fluid, which will force issuers and distributors to continuously innovate on loyalty and attention rather than relying on inertia.\n\nIn practice, this will push branded stablecoins to adopt tactics similar to those in memecoin markets: competing for attention, narrative, and cultural resonance. \n\nThe central question becomes: _what association commands the most eyeballs?_ Large corporations will capture share by embedding rewards into their existing ecosystems. But a market segment that remains underdeveloped in the offchain card world, **celebrities and influencers**, is uniquely positioned to thrive in a branded stablecoin paradigm.\n\n## Celebrity Stablecoins\n\nNo one commands attention like global athletes, pop stars, and YouTubers. By launching “celebrity stablecoins,” issuers can partner with figures like Lebron James, Taylor Swift, or Mr. Beast, aligning incentives for everyone involved. The issuer gains float and distribution, the celebrity deepens fan engagement while receiving a share of float yield, and consumers receive tangible perks. \n\nFor example, holding a Taylor Swift Dollar Coin (TSDC) could unlock exclusive concert tickets, merch, or airdrops. Because wallet activity is visible, partners such as Spotify or guitar manufacturers could target offers directly to Swift’s fan base, layering additional value onto the same loyalty rails. Smaller brands with less recognition could piggyback on these celebrity ecosystems, reaching audiences they could never build alone.\n\n\n\nUnlike creator tokens or celebrity memecoins, **celebrity stablecoins avoid reputational risk.** Their value is stable; fans don’t lose money when prices crash. Rewards are framed as loyalty benefits rather than speculative bets, making them intuitive and consumer-friendly. Issuers can even share a portion of float revenue with celebrities, structured as marketing or licensing fees, further aligning incentives. \n\n\n\nFrom a policy perspective, every celebrity stablecoin is still a U.S. dollar at its core, meaning each one expands dollar dominance globally. For regulators, that outcome strengthens U.S. monetary reach while allowing issuers to capture market share through cultural distribution.\n\nIn this model, money itself becomes a **canvas for culture.** Stablecoins are no longer interchangeable commodities; they are differentiated loyalty containers competing for attention in the same way brands and influencers compete for relevance today.\n\n## The Path to Branded and Celebrity Stablecoins\n\nIf **loyalty and attention** emerge as the true bottlenecks, the key questions become _when_ this transition will occur and _which issuers or partners_ are best positioned to capture it.\n\n### The Role of New Market Entrants\n\nIf traditional financial institutions were the only players entering the stablecoin market, the transition to branded stablecoins would likely be slow, or might not occur at all. Banks are culturally conservative and have little incentive to experiment with consumer-facing loyalty mechanics beyond existing credit card programs.\n\nBy contrast, **Big Fintech** and **crypto-native companies** have proven track records in user acquisition, gamified design, and rapid iteration. They are comfortable competing on the basis of attention and loyalty in ways banks are not.\n\n#### **Robinhood**\n\n[Robinhood](https://messari.io/project/robinhood-exchange) illustrates this dynamic. The company made its name by pioneering commission-free trading, [gamifying](https://finmasters.com/gamification-of-investing/#gref) the brokerage experience, and offering bold retail-facing products like options. It embraced crypto early, listing [Bitcoin and Ethereum](https://www.cnbc.com/2018/01/25/stock-trading-app-robinhood-to-roll-out-bitcoin-ethereum-trading.html#:~:text=Stock%20trading%20app%20Robinhood%20is,in%20February%2C%20Robinhood%20announced%20Thursday.) in February 2018 and entering the memecoin space with [Dogecoin](https://newsroom.aboutrobinhood.com/dogecoin-is-now-on-robinhood-crypto/) in July of the same year.\n\n\n\nToday, Robinhood is doubling down on crypto with the announcement of the [Robinhood](https://messari.io/report/robinhood-chain-three-key-takeaways)[ ](https://messari.io/report/robinhood-chain-three-key-takeaways)[Chain](https://messari.io/report/robinhood-chain-three-key-takeaways), a layer-2 (L2) built with [Arbitrum](https://messari.io/project/arbitrum), and the expansion of its crypto footprint. \n\nRobinhood’s DNA, retail-first, crypto-friendly, and attention-driven, makes it a natural candidate to experiment with branded or celebrity stablecoins. Given that its CEO, Vlad Tenev, [stated](https://x.com/vladtenev/status/1942632139503116622) that “tokenization is the greatest innovation in capital markets since the central limit order book,” we expect ambitious strategies to be implemented to win market share, and celebrity stablecoins would be far from the boldest move they’ve made.\n\n#### **Stripe and Coinbase**\n\nOther fintechs are moving in similar directions. Stripe launched stablecoin financial accounts across [101 countries in mid-2025](https://stripe.com/blog/introducing-stablecoin-financial-accounts), powered by Bridge, and is reportedly building a [Layer-1 (L1), “Tempo,”](https://cryptobriefing.com/stripe-builds-tempo-blockchain-paradigm/) in partnership with Paradigm. While less bold in targeting retail than Robinhood, Stripe would likely not hesitate to compete head-on with branded stablecoins to stay competitive due to its focus on execution and what works.\n\nCoinbase has aggressively expanded its infrastructure footprint with the launch of **Base**, while signaling ambitions to build an “[everything app](https://www.cnbc.com/2025/07/16/coinbase-steps-into-consumer-market-with-stablecoin-powered-everything-app-that-goes-beyond-trading.html)” integrating stablecoins, tokenized stocks, and DEX integrations. As it attempts to compete with players like Robinhood entering crypto from fintech, it will need to compete on all major fronts, and branded stablecoins would certainly not be off the table.\n\nThe intense competition emerging from the TAM and profitability of stablecoins is likely to push tech-savvy giants in fintech and crypto to pursue ambitious strategies to win market share, increasing the likelihood of branded stablecoins and even celebrity stablecoins reaching the mass market.\n\n#### **Well-Backed Startups**\n\nAs discussed above, startups like **Agora** and **M0** are already developing white-labeled solutions for third-party brands and companies. As the competitive frontier shifts toward loyalty and attention, these firms, still in search of product-market fit, are likely to lean harder into branded stablecoins as a natural extension of their core strategy.\n\n#### **Pressure on Incumbents**\n\nThe presence of such ambitious challengers is also pressuring incumbents such as Tether, Circle, and Paxos. Circle has shown urgency with the launch of its own L1, [Arc](https://www.circle.com/blog/introducing-arc-an-open-layer-1-blockchain-purpose-built-for-stablecoin-finance), highlighting the risk that neutral issuers face commoditization if they only compete on existing paradigms rather than move fast in response to competition.\n\n\n\n### Branded Stablecoin Outlook\n\nTaken together, the competitive picture is clear. As fintechs, crypto platforms, and startups compete to capture stablecoin economics, their track records of bold product launches suggest that **branded tokens and celebrity stablecoins will arrive faster than most expect.** The pace of competition will also force incumbents like Circle and Tether to adapt, shifting their own product strategies in a market where culture and loyalty, not just liquidity and compliance, determine adoption**.**\n\nThe open questions are when they arrive and which combination of issuers, fintechs, brands, and celebrities will define the category.\n\n## Branded RWAs and Hyper-Tokenization\n\nLooking further ahead, the same dynamics that make loyalty-linked stablecoins and celebrity-branded tokens compelling could extend into RWAs as tokenization matures. The combination of programmable loyalty mechanics and attention-based economics will not be confined to payments. Over time, it may apply to a broad range of tokenized assets.\n\nConsider a world where Apple stock or 10-year U.S. Treasuries exist at scale as tokenized instruments. In such a scenario, we could plausibly see products like _Taylor Swift Apple (TsAAPL)_ or _MrBeast 10YR_, wrappers that bundle mainstream financial products with the loyalty hooks and cultural cachet of a celebrity or brand. Just as with stablecoin issuers, tokenized asset issuers could create white labeled or co-branded tokens to increase attention. These instruments would not replace the underlying assets. Instead, they would serve as distribution layers that differentiate commoditized financial exposure through consumer engagement, perks, and brand alignment as all assets make their way onchain.\n\nTo be clear, this scenario requires significant infrastructure buildout, regulatory clarity, and cultural acceptance. Tokenization of RWAs remains in its early innings. BlackRock’s BUIDL fund surpassed [$2.3B in AUM](https://app.rwa.xyz/treasuries), and Franklin Templeton’s tokenized money market fund crossed [$750M](https://app.rwa.xyz/treasuries), but these remain small fractions of global financial flows. Regulatory frameworks could also evolve in ways that restrict branded overlays. For example, it is entirely plausible that U.S. regulators draw a hard line between tokenized Treasuries as institutional instruments and consumer-facing loyalty mechanics layered on top. In the near term, such restrictions may even be the base case.\n\nStill, the playbook is already visible. If celebrity stablecoins demonstrate that loyalty + attention can drive adoption in a commoditized category like money, it is only natural that the same model would be applied to tokenized equities, treasuries, real estate, and other RWAs once the rails are in place. Financial products long treated as purely functional could be reimagined as distribution contests layered with cultural identity and loyalty economics**.**\n\nThe broader lesson is that user-facing design can redefine categories once assumed to be interchangeable. Stablecoins will show this first, but tokenized RWAs could follow a similar arc: from unbranded utilities to branded experiences, where culture determines who wins market share.\n\n## Conclusion\n\nThis report highlights where the next competitive bottleneck will emerge in the stablecoin and broader tokenization markets. Over the next 3-5 years, competition is likely to shift from distribution, already well underway, to loyalty and attention, where branded and celebrity stablecoins will become the decisive battleground. Stakeholders that begin preparing for this transition now, through strategic partnerships, early experiments in loyalty design, and organizational readiness to move quickly, will be positioned to separate themselves from slower-moving incumbents and TradFi entrants.\n\nWinning distribution today is necessary, but it is **not sufficient.** The deeper challenge is anticipating what comes next: the fusion of crypto-native culture with traditional financial assets, and eventually the rise of branded RWAs**.**\n\nImportantly, the current U.S. administration has signaled a more favorable stance toward crypto innovation, creating an environment where **boldness, not caution, is rewarded.** The blending of memetic cultural distribution engines with financial utility is likely to define the next adoption wave. \n\nThe lesson is simple: do not assume that TradFi will simply impose its systems and values on crypto. Historical transitions are never that straightforward. Instead, we should expect a **two-way exchange**, where crypto-native culture, community, and design reshape how traditional assets are packaged, distributed, and competed over. The winners of the tokenization era will be those that recognize this dynamic early and align their strategies accordingly.",

"hook": "This report examines how stablecoin competition is moving beyond distribution toward loyalty and attention, arguing that branded and celebrity stablecoins, and eventually branded RWAs, will define the next phase of tokenization.",

"publishDate": "2025-08-22T17:21:00Z",

"readingTimeInMinutes": 15.331666666666667,

"slug": "beyond-the-stablecoin-distribution-bottleneck-branded-stablecoins-loyalty-programs-the-attention-economy-celebrity-stablecoins-and-the-convergence-of-tradfi-fintech-and-crypto",

"subscriptionTier": "enterprise",

"summary": "This report explores how stablecoin competition is shifting beyond distribution toward loyalty and attention as the decisive drivers of adoption. Drawing lessons from the history of credit cards, it argues that branded and celebrity stablecoins will emerge as the next stage of differentiation, extending into co-branded and white-labeled tokens. The analysis also considers the eventual rise of branded RWAs, where tokenized assets are reimagined through cultural and loyalty overlays. Stakeholders are urged to prepare now for this transition, as the fusion of crypto-native culture with traditional finance will reshape the trajectory of tokenization.",

"tags": [

{

"id": "b91556d7-765c-4b98-b11f-665485c2d908",

"name": "Stablecoins"

},

{

"id": "3cf4ee65-4f37-4130-9bb6-5a899a64fb68",

"name": "Memecoins"

},

{

"id": "9a329d89-97bb-4b33-a1a4-2cb0e3d63afe",

"name": "Tokenomics"

},

{

"id": "50fa434c-ec22-4af1-940e-0c140864a22c",

"name": "Web3"

},

{

"id": "8ef53cf6-d66a-48e3-bf0d-03da8cfdca14",

"name": "Consumer"

}

],

"title": "Beyond the Stablecoin Distribution Bottleneck: Branded Stablecoins, Loyalty Programs, the Attention Economy, Celebrity Stablecoins, and the Convergence of TradFi, Fintech, and Crypto."

},

{

"id": "21fed96f-3bdf-4bf5-8bed-08e4659f2aff",

"createdAt": "2025-01-24T05:42:19Z",

"updatedAt": "2025-01-24T15:06:42Z",

"assetIds": [

"bcbe9ab0-8a03-4295-bd4c-5e4d7caf1026",

"7e532302-9ced-4e90-8c8a-218a38e1dbba"

],

"assets": [

{

"id": "bcbe9ab0-8a03-4295-bd4c-5e4d7caf1026",

"name": "Official Trump",

"symbol": "TRUMP",

"slug": "official-trump"

},

{

"id": "7e532302-9ced-4e90-8c8a-218a38e1dbba",

"name": "Melania Meme",

"symbol": "MELANIA",

"slug": "melania-meme"

}

],

"authors": [

{

"id": "2a49c71e-ac60-4630-a145-f16bec762ed0",

"name": "Sunny Shi",

"image": "https://cdn.sanity.io/images/2bt0j8lu/production/fcf26337bf630d89555757f090a2e4fd15b742ca-256x256.webp?w=100",

"linkedinUrl": ""

},

{

"id": "ee645061-729f-49c2-96ff-4aaf1eb62050",

"name": "Kinji Steimetz",

"image": "https://cdn.sanity.io/images/2bt0j8lu/production/3b1398c35274334eacecb25fdf6931db9ae91634-512x512.png?w=100",

"linkedinUrl": ""

},

{

"id": "f69a6e38-eed2-489d-956f-df03541a8992",

"name": "Andrew Dyer",

"image": "https://cdn.sanity.io/images/2bt0j8lu/production/3a0449c1821215d1e1ae17854c948390115d5a04-511x512.png?w=100",

"linkedinUrl": ""

},

{

"id": "6a7f467f-5dbf-4ba5-a8b4-499af94fd2c4",

"name": "Dylan Bane",

"image": "https://cdn.sanity.io/images/2bt0j8lu/production/db9a9c7bcea81c62c3ebabff017525acf5bf7bd3-772x780.png?w=100",

"linkedinUrl": ""

}

],